Another year, another corporate tax evasion scandal

Written by: on

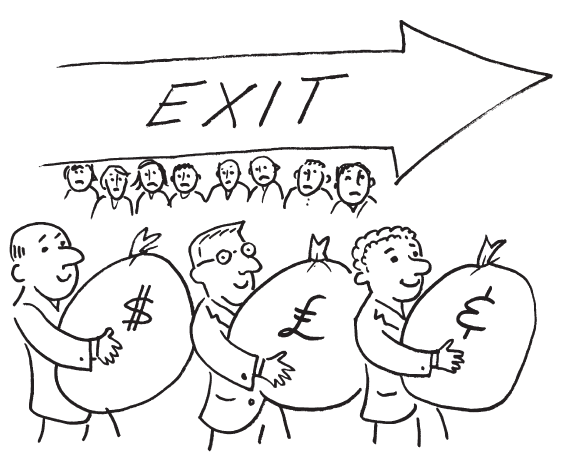

New information released by the Australian Tax Office shows that some of the biggest foreign and local companies paid no tax in Australia last year.

To be included in the list, public and foreign-owned companies must have had an annual income in excess of $100m, while locally-owned entities had to have had an income in excess of $200m.

This excludes from public scrutiny a vast number of companies, many of whom also paid no tax.

Out of more than 1900 public, foreign and locally-owned entities in the high-income brackets, 670 (more than one third) paid no tax.

Cross-checking between companies in the “A” alphabetic section of the 2013-14 and 2014-5 lists from the ATO reveals that of the 92 companies that paid no tax last year, 59 or 64% of them had paid no tax the year before either.

They include AZSA Holdings Pty Ltd, a Sydney-based coal mining services company that operates as a subsidiary of the giant Glencore plc., an Anglo-Swiss corporation.

In 2013-14, AZSA’s income was $3.774bn. It paid no tax. In 2014-15, its income was $3.59bn. It paid no tax.

Its parent company, Glencore, operating here as Glencore Australian Investment Holding Co. Ltd. earned $1.074bn in 2013-14 and $1.481bn in 2014-15 and paid no tax either year.

Operating as Glencore Investment Pty. Ltd. it earned $4.611bn in 2013-14 and $4.968bn in 2014-15 and paid no tax either year.

Last year it also operated as Glencore Investment Holdings Australia Ltd. and earned $7.787bn on which it paid zero tax.

The US giant ExxonMobil Australia Ltd. is another that has paid no tax in either year. In 2013-14 it earned $9.617bn whilst last year it earned $8.464bn.

ExxonMobil’s chairperson Rex Tillerson has just been nominated by President-elect Donald Trump to be his Secretary of State. Asked about the nomination, Australia’s Foreign Minister Julie Bishop told the ABC’s AM program that “there are many Australians who have worked with him in Exxon Mobil.

“Of course Exxon Mobil have investments in Australia, in the Bass Strait, in the Gorgon Field in north-west Australia. They are the major investor in PNG in the LNG PNG project. So he knows Australia and PNG and our region well and we will seek to engage with him should he be the nominee and confirmed by the Senate for secretary of state.”

She made no mention of “engaging” with him on the question of his ripping the economic guts out of our country and refusing to pay tax here.

Meanwhile, and despite ludicrous claims to be cracking down on multinational tax evasion, senior Government Ministers tried to divert attention from the issue by claiming that 35000 Australians had turned down job offers to stay on “generous taxpayer-funded welfare payments”.

This pubic attack on and humiliation of unemployed and under-employed Australians shows just where the loyalties of these political leeches lie.

And unless we simply want to shrug our shoulders every time the ATO rolls out its list of rich tax avoiders, unless we are happy to see our schools and hospitals not being built for lack of corporate tax payments, we must get organised in our unions and communities to really “Make the Rich Pay!”

Print Version - new window Email article

-----

Go back

Independence from Imperialism

People's Rights & Liberties

Community and Environment

Marxism Today

International

Articles

| On the introduction of supermarket security checkpoints |

| WOMAD: Marley to perform, Palestinian musicians banned |

| International Women’s Day lifts struggle for liberation of women and socialism! |

| ICOR Call for International Women’s Day |

| We support the international campaign to free Ecevit Piroğlu |

| Workers’ power and closing the loopholes industrial laws |

| Sovereignty, a message to whitefellas |

| When whitefellas dance Ceremony, it’s time for consequences |

| RIghts Of Indigenous Peoples’ Struggles Continue As Governments Side With The Big End Of Town |

| Community school mural censored over First Nations artist's identity with Palestinians |

| Miko Peled speaks truth about the Zionist war against Palestine |

| #FreeDanDuggan - A Fight for Freedom and Australian Sovereignty |

| Mr Mundine, stop harming kids if you want them to go to school! |

| Opposition to Zionism is not anti-Semitism. |

| How Secure Are Australia's Defence Bases? |

| Corporate management and the Alliance for Responsible Citizenship |

| Imperialism and the Israeli state condemned Palestinians to poverty. |

| Microsoft buys into AUKUS and Australian surveillance industry |

| After the referendum, we cannot fight blindly |

| Dan Duggan - a shameful anniversary |

-----